How Much Does Holding A Property Cost in Hollywood, FL

If you’re searching for “How Much Does Holding A Property Cost in Hollywood, FL,” chances are you’re feeling the weight of your decision-making process as a property owner. Maybe you’ve inherited a property, are struggling to maintain a home, or simply find yourself stuck with a house that isn’t producing the income you hoped for. You’re likely facing mounting expenses like taxes, insurance, maintenance, and utilities, and you want to understand the full financial picture before making any decisions about selling or holding onto the property. The costs can seem endless, and you might be wondering if it’s worth continuing to hold the property or if selling it for cash might be a more profitable or stress-free option. You’re likely seeking clarity on exactly what these holding costs will run you, what hidden expenses you may not have considered, and whether it’s better to sell now before these costs continue to add up.

In this blog, we’ll break down the primary costs associated with holding a property in Hollywood, FL, including taxes, utilities, repairs, and more, providing you with a clear picture of what you can expect in terms of expenses. This will help you make an informed decision about whether holding onto your property is financially sustainable or if selling might be a more beneficial choice for your circumstances.

Understanding Property Holding Costs in Hollywood, FL

Owning a property comes with many responsibilities and associated costs that can quickly add up. Whether you’ve inherited a property, bought one as an investment, or are simply holding onto a house for future plans, understanding the financial commitment of keeping a property is crucial. In Hollywood, FL, property owners face unique challenges that can influence the overall cost of holding a property. These costs may include property taxes, insurance, utilities, maintenance, and other unexpected expenses that can drain your budget over time.

Before you make a decision on whether to sell or continue holding, it’s essential to understand how much you’ll be spending and whether it makes financial sense to hold the property long-term. In this guide, we will explore the major factors influencing property holding costs in Hollywood, FL, and help you assess whether keeping your property is worth the financial burden.

Property Taxes in Hollywood, FL: A Significant Ongoing Cost

One of the most significant holding costs for property owners in Hollywood, FL, is property taxes. Florida has relatively high property taxes compared to some other states, and this can be a financial strain if you’re holding a property that is not generating income or if you don’t live in the property. In Hollywood, the average property tax rate is about 1.06% of the property’s assessed value. This means that for a property worth $250,000, you could be paying about $2,650 annually in property taxes alone.

These taxes are due annually, but many owners find themselves paying them in installments throughout the year. If you’ve been holding onto a property that has increased in value or hasn’t been reassessed in years, the property tax rate could be even higher. It’s important to factor in the potential increase in taxes due to rising property values and reassessments. And if the property is vacant, you might not benefit from certain homestead exemptions, which could increase your tax burden.

The burden of paying property taxes can be significant, especially if you don’t have renters generating income from the property. This ongoing expense can become a financial strain over time, especially if your property isn’t performing or you are unsure about selling it.

For more information on the costs of selling a house in Florida, including taxes, fees, and other expenses, visit our How Much Will Listing Your House Really Cost in Florida? page.

Homeowners Insurance: Protecting Your Investment at a Price

Homeowners insurance is another unavoidable cost for property owners in Hollywood, FL. While it’s crucial to protect your property from potential disasters, the cost of insurance can vary depending on the property’s value, age, and location. In Florida, homeowners insurance can be expensive due to the risk of hurricanes, flooding, and other natural disasters.

On average, homeowners insurance in Florida costs about $3,600 per year, but this amount can fluctuate based on your property’s location and condition. Homes closer to the coast or in flood zones typically require additional coverage for wind and water damage, which can drive insurance premiums even higher. Even if you’re not actively living in the property, you’ll need to maintain an insurance policy to avoid risking severe financial loss in the event of damage.

For more details on how to calculate homeowners insurance costs, visit Bankrate’s Homeowners Insurance Guide.

For those who own investment properties, the costs of insuring a vacant home are often higher. Insurance premiums could double or even triple for unoccupied properties due to the increased risk of vandalism or damage without regular upkeep. If your property is vacant for an extended period, you could end up paying much more than you initially anticipated for insurance.

Utilities and Maintenance: Hidden Ongoing Costs

Another often-overlooked cost when holding onto a property is the monthly expenses associated with utilities and maintenance. Even if the property isn’t being lived in or rented out, you’ll still need to maintain utilities like electricity, water, and gas to keep the property in good condition. These costs can accumulate quickly, particularly during hot summer months when air conditioning is required or during winter when heating is necessary.

For instance, utility costs for a vacant property in Hollywood, FL, can range from $150 to $400 per month, depending on the size and type of utilities required. In addition, you’ll have ongoing maintenance costs like lawn care, pest control, and basic repairs that need to be addressed regularly to avoid the property falling into disrepair. Neglecting these maintenance tasks can result in higher costs down the line to address serious issues like mold, roof damage, or plumbing problems.

For instance, lawn care for an unoccupied property in Hollywood can run between $75 and $150 per visit. If you are paying for pest control, this could cost an additional $30 to $100 per month. Small maintenance tasks such as fixing leaks, replacing light bulbs, or keeping appliances in working order also add to the expense. Over time, the costs of utilities and maintenance can significantly increase the overall cost of holding a property.

To learn more about how unexpected costs like maintenance and insurance can affect your sale, read our What are Closing Costs Exactly in Florida? article.

Opportunity Costs: What You’re Losing By Holding the Property

While holding onto a property might seem like the best option in some cases, it’s important to consider the opportunity costs associated with keeping it. Opportunity cost refers to the benefits you miss out on by not selling the property and investing that money elsewhere.

For example, if you continue to hold a property in Hollywood, FL, without renting it or using it in a profitable way, you’re losing out on potential investment gains. If you’re paying thousands of dollars each year in taxes, insurance, and maintenance for a property that isn’t generating income, this money could be better spent elsewhere. Instead of holding onto a non-performing property, you could invest in a more profitable venture or use the cash from selling to eliminate debts or improve your financial position.

Additionally, holding onto a property in a fluctuating market could lead to missed opportunities if property values start to decrease. If you wait too long to sell, you might not get the price you expect for your home. This is especially true if the market in Hollywood is down or if there is significant competition from other sellers. Selling quickly can sometimes result in a better return than holding out for an ideal price.

For insights into investment opportunities, visit Investopedia’s Guide on Opportunity Cost.

The Financial Impact of Extended Vacancies

For many property owners, the most significant concern when holding onto a property is the cost of vacancy. A vacant property can result in higher insurance costs, utilities, and maintenance as we discussed earlier. However, the longer your property remains vacant, the more likely you are to face additional challenges.

Vacant properties are also at higher risk of vandalism, theft, or other damage due to the lack of security. This could lead to more repairs or even legal fees if you need to address issues like trespassing or squatters. Furthermore, an empty property can negatively affect your mental well-being and add to the stress of owning a home that isn’t producing any value.

Many property owners face the challenge of having an unoccupied home for months or even years, all while the costs pile up. It’s not uncommon for owners to end up spending far more on a vacant property than they originally anticipated. If you’re experiencing an extended vacancy, it may be time to seriously consider selling rather than continuing to bear the financial burden.

Frequently Asked Questions

Q. What costs are involved in holding a property in Hollywood, FL?

Holding a property in Hollywood, FL includes expenses like property taxes, insurance, utilities, maintenance, HOA fees, and mortgage interest if applicable.

Q. How much are property taxes in Hollywood, FL?

Property taxes in Hollywood, FL vary by assessed value, but homeowners generally pay around 1–2% of the home’s assessed value annually.

Q. Does homeowner’s insurance increase the cost of holding a house in Hollywood, FL?

Yes — homeowner’s insurance is a recurring holding cost, especially in Florida where wind and hurricane coverage can raise premiums.

Q. How do utilities and maintenance affect holding costs in Hollywood, FL?

Utilities and ongoing maintenance (like landscaping, repairs, pest control) add up monthly, increasing the total cost of holding an unoccupied or under‑used property.

Q. Can holding costs in Hollywood, FL cause financial strain?

Yes — if you’re paying mortgage, taxes, insurance, and upkeep without rental income or sale proceeds, holding costs can quickly strain finances.

Q. How can I reduce holding costs for my property in Hollywood, FL?

You can reduce holding costs by selling your home fast for cash, renting it out, negotiating lower insurance premiums, or minimizing utility usage.

Conclusion: Why Selling to Property Solution Services LLC Might Be Your Smartest Financial Move

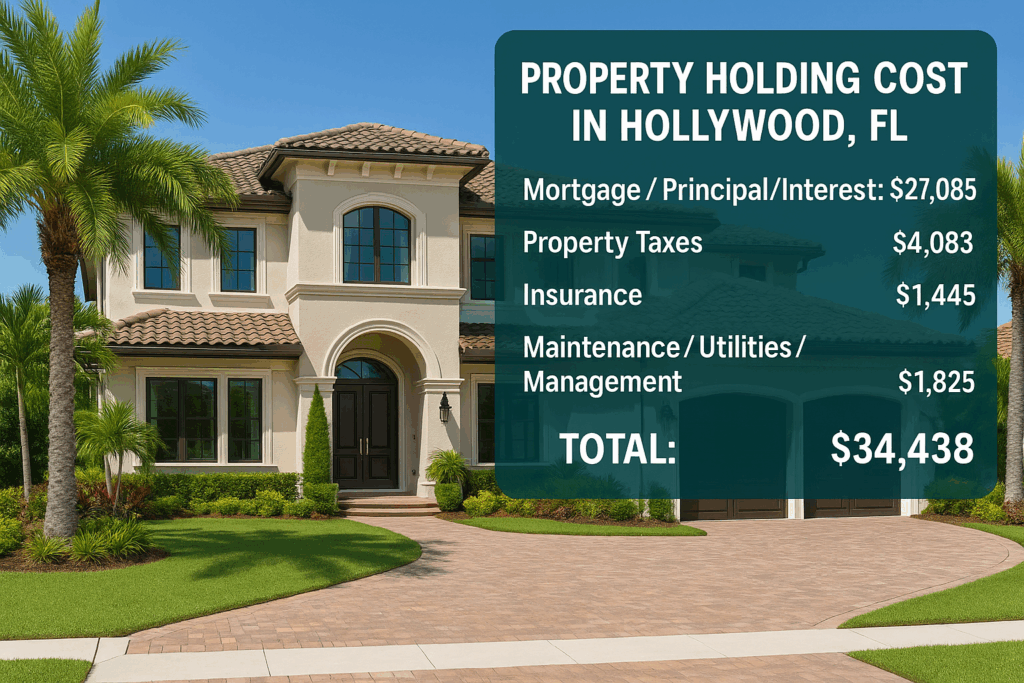

When you add up the ongoing expenses—property taxes, insurance premiums, rising utility bills, maintenance, and the often-overlooked opportunity costs—it becomes clear that holding onto a property in Hollywood, FL, can drain your finances quickly. The burden can be even heavier if the property sits vacant or is in need of repairs. While it might seem like a smart strategy to wait for a higher market price or to figure things out later, the reality is that every month you hold that property, you’re potentially throwing away hundreds or even thousands of dollars.

At Property Solution Services LLC, we understand the stress and uncertainty that comes with owning a property that’s costing more than it’s worth. That’s why we make the process of selling fast, simple, and stress-free. When you work with us, there’s no need to pay for repairs, cleanups, real estate agent fees, or closing costs. We buy houses in any condition, for cash, and on your timeline.

Instead of letting these holding costs continue to pile up, imagine walking away with cash in hand and none of the headaches. Whether you’re dealing with an inherited home, going through a divorce, facing foreclosure, or just tired of paying for a property you no longer want, Property Solution Services LLC is here to help.

Don’t let your property keep bleeding your wallet dry. Reach out to us today for a no-obligation, fair cash offer—and take the first step toward financial freedom and peace of mind.