Introduction

Brief Overview: What is a Home Equity Loan and Why It’s Relevant to Homeowners Looking to Sell

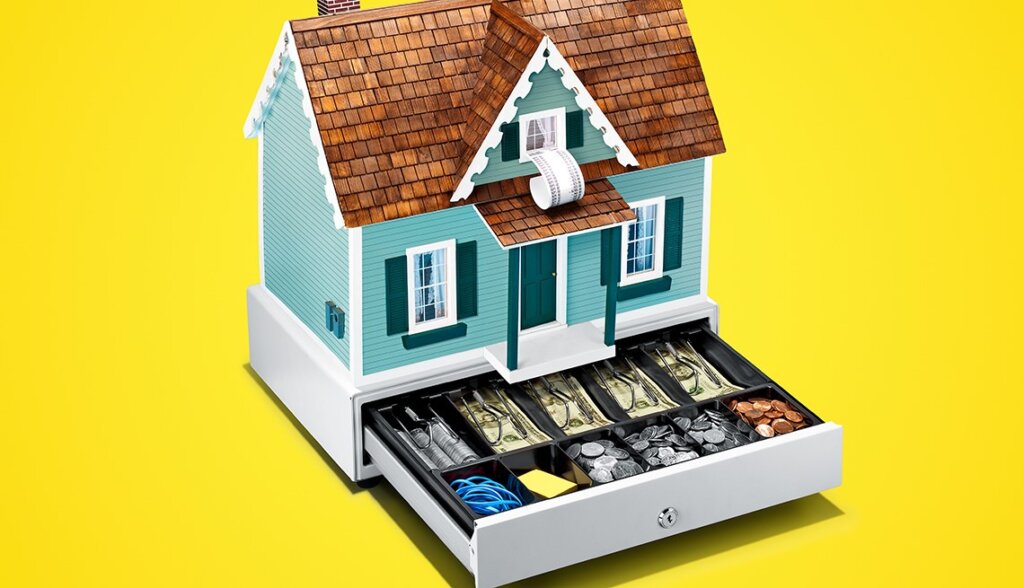

Selling a home is a big decision and often comes with a mix of emotions and practical challenges. One tool that homeowners can leverage during the selling process is a home equity loan. A home equity loan allows homeowners to tap into the value of their property by borrowing against the equity they have built up over the years. This can be especially valuable for those looking to make repairs or cover additional selling expenses as they prepare their home for the market.

In Pembroke Pines, FL, where the real estate market is dynamic, utilizing a home equity loan can give sellers the financial flexibility to ensure their property is in the best possible condition to attract buyers. By understanding how a home equity loan works and how it can be used strategically, you can maximize the value of your sale.

Purpose of the Guide: How Using a Home Equity Loan Can Help in Selling a Home in Pembroke Pines

This comprehensive guide will walk you through the steps of using a home equity loan to sell your home in Pembroke Pines, FL. We’ll explore why it’s a useful option, how to determine if it’s the right choice for you, and how to navigate the process efficiently.

What is a Home Equity Loan?

Definition: A Home Equity Loan Explained

A home equity loan is a type of loan that allows homeowners to borrow money using the equity in their home as collateral. Equity is the difference between the current market value of your home and what you owe on your mortgage. For example, if your home is worth $300,000 and you owe $150,000 on your mortgage, your equity is $150,000.

How It Works: A Breakdown of Borrowing Against Your Home’s Equity

When you take out a home equity loan, the lender provides you with a lump sum of money based on your home’s equity. This loan can be used for a variety of purposes, such as paying off debt, covering selling expenses, or funding home renovations. Typically, home equity loans have fixed interest rates and are repaid over a set term, often between 5 and 30 years.

For detailed guidance on home equity loans and lines of credit, refer to the Consumer Handbook on Home Equity Lines of Credit published by the Federal Reserve.

Difference Between Home Equity Loan and Line of Credit (HELOC)

It’s important to distinguish between a home equity loan and a Home Equity Line of Credit (HELOC). A home equity loan provides a lump sum of money upfront with a fixed interest rate, while a HELOC functions more like a credit card, offering a revolving line of credit that you can borrow from and pay back repeatedly. Both options have their pros and cons, but for a straightforward lump sum, a home equity loan is generally the preferred option for sellers who need immediate cash.

Why Consider Using a Home Equity Loan to Sell Your House?

Accessing Cash Quickly

Selling a house can incur many expenses, from repairs and staging to closing costs. A home equity loan can provide the cash needed to cover these costs upfront, allowing you to invest in preparing your property for sale without delay. With the competitive real estate market in Pembroke Pines, quick access to funds can help you get your home ready and listed without financial stress.

Paying Off Debt or Renovations

Many homeowners use the proceeds from a home equity loan to consolidate debt or make renovations to improve their home’s value before selling. For instance, a kitchen or bathroom remodel can significantly boost your home’s appeal to prospective buyers. With a home equity loan, you can fund these projects and increase your chances of selling your home at a higher price.

Financial Flexibility

A home equity loan offers financial flexibility during the selling process. By borrowing against your home’s equity, you can create a clear plan to pay off debts, address necessary repairs, and still have enough funds to manage other expenses related to the move. This flexibility is crucial, especially if you need to sell quickly.

Is a Home Equity Loan the Right Option for You?

Eligibility Requirements

To qualify for a home equity loan, there are several factors lenders will consider:

- Home Value vs. Loan Amount: Lenders typically allow you to borrow up to 80% of your home’s equity. If your home is worth $300,000, you could potentially borrow up to $240,000 (depending on other factors).

- Credit Score and Debt-to-Income Ratio: Lenders will evaluate your credit score and debt-to-income ratio to determine your eligibility for a loan. A higher credit score improves your chances of getting favorable terms.

- Length of Homeownership: Lenders may require that you’ve owned your home for at least 3 to 5 years, although this can vary depending on the lender.

Pros of Using a Home Equity Loan

- Lower Interest Rates: Home equity loans generally offer lower interest rates compared to personal loans and credit cards.

- Fixed Payment Terms: With fixed interest rates, your monthly payments remain consistent, making budgeting easier.

- Potential Tax Benefits: In some cases, the interest paid on a home equity loan may be tax-deductible (consult a tax advisor for details).

Cons of Using a Home Equity Loan

- Risk of Foreclosure: If you fail to repay the loan, the lender can foreclose on your property, potentially putting your home at risk.

- Accruing Interest Costs: While home equity loans tend to have lower interest rates, the interest will still accumulate over time, which can add up if the loan is not repaid quickly.

- Impact on Sale Proceeds: Repaying the loan will reduce your sale proceeds, as the outstanding loan balance must be paid off from the sale price.

Step-by-Step Guide to Selling Your Home with a Home Equity Loan

Step 1: Evaluate Your Home’s Equity

Before applying for a home equity loan, you need to assess how much equity you have in your property. Home equity is calculated as: Home Equity=Current Home Value−Remaining Mortgage Balance\text{Home Equity} = \text{Current Home Value} – \text{Remaining Mortgage Balance}Home Equity=Current Home Value−Remaining Mortgage Balance

For example, if your home is worth $350,000 and you owe $200,000 on your mortgage, your equity is $150,000. To determine how much you can borrow, most lenders allow you to borrow up to 80% of your home’s equity. Here’s a breakdown:

| Home Value | Mortgage Balance | Equity | Max Loan Amount (80%) |

|---|---|---|---|

| $350,000 | $200,000 | $150,000 | $120,000 |

Step 2: Apply for a Home Equity Loan

Once you’ve evaluated your home’s equity, the next step is to apply for a loan. You can apply at:

- Banks: Traditional financial institutions with experience in home equity loans.

- Credit Unions: Often offer competitive rates and flexible terms.

- Online Lenders: Fast approval processes, but rates can vary.

Documentation Required:

- Proof of income (pay stubs, tax returns).

- Your credit score.

- Appraisal or proof of your home’s value.

Loan Approval Process

After you submit your application, the lender will assess your credit, verify your home’s value, and determine the amount they’re willing to lend you. The approval process typically takes 2 to 4 weeks, but this can vary.

For a detailed guide on the home equity loan application process, check out Bankrate’s Home Equity Loan Approval Process.

Step 3: Use the Loan to Prepare Your Home for Sale

Once your home equity loan is approved, you can use the funds for home improvements, repairs, or even staging. Here are some cost-effective ideas to increase your home’s value:

- Fresh Paint: A fresh coat of paint can make a big difference.

- Kitchen Updates: Replacing cabinet hardware or updating countertops can yield a high return on investment.

- Landscaping: Curb appeal matters. Simple landscaping can enhance first impressions.

Step 4: List Your Home for Sale

Choosing a real estate agent with experience in the Pembroke Pines market is crucial. They can help you price your home correctly, factoring in both the loan repayment and the current market trends.

- Setting the Right Price: Make sure your home is competitively priced. Factor in the home equity loan balance and closing costs.

For a detailed guide on pricing your home effectively for sale, check out How to Price Your Home to Sell – Zillow.

Selling Your Home and Paying Off the Loan

How the Sale Proceeds Work

When your home sells, the sale proceeds will first go toward paying off the mortgage and any other outstanding debts, including your home equity loan. Let’s say your home sells for $350,000, and you have a $200,000 mortgage balance and a $120,000 home equity loan. Here’s how the proceeds break down:

| Item | Amount |

|---|---|

| Sale Price | $350,000 |

| Mortgage Balance | $200,000 |

| Home Equity Loan | $120,000 |

| Closing Costs | $15,000 |

| Total Sale Proceeds | $15,000 |

Paying Off the Home Equity Loan

To ensure the loan is fully repaid, make sure the lender receives the appropriate amount at closing. If the sale proceeds exceed the loan amounts, you will receive the surplus.

What to Do if Your Home Doesn’t Sell Quickly

If your home doesn’t sell right away, you have several options:

- Refinancing or Extending Loan Terms: If you need more time, you may be able to extend the loan or refinance it.

- Renting Out the Property Temporarily: If you’re unable to sell, renting it out can provide additional income.

Alternative Financing Options

If a home equity loan is not suitable, consider other options like a HELOC or a personal loan for sale-related expenses.

Tips for Successfully Selling Your Home in Pembroke Pines

Understand the Local Market

Stay informed about local market trends in Pembroke Pines. Competitive pricing, market demand, and neighborhood appeal will influence your sale.

Be Prepared for Negotiations

Negotiating the terms of your sale can affect your bottom line, so be prepared to make compromises.

Work with a Real Estate Expert

Consult with a real estate agent experienced in working with home equity loan transactions.

Frequently Asked Questions (FAQs)

1. Can I sell my house before paying off my home equity loan?

Yes, you can sell your house before paying off the home equity loan. When you sell, the loan will be paid off from the proceeds of the sale. The remaining balance, after repaying the loan and any associated closing costs, will be yours.

2. Will using a home equity loan impact the sale price of my house?

Using a home equity loan itself doesn’t directly impact the sale price. However, if the home equity loan balance is high, it may reduce the amount of profit you make from the sale. The key is to ensure that the sale price covers both the loan balance and other selling costs.

3. What happens if I owe more on my home equity loan than my house is worth?

If you owe more on your home equity loan than the current market value of your home (a situation known as being “underwater”), you may not have enough proceeds from the sale to pay off the loan. In this case, you may need to bring additional cash to closing to settle the difference or consider negotiating with your lender.

4. How much equity do I need to qualify for a home equity loan?

Most lenders allow you to borrow up to 80% of your home’s appraised value minus your existing mortgage balance. For example, if your home is worth $300,000 and you owe $150,000, you could potentially borrow up to $120,000. The amount of equity you have will be a determining factor in the loan amount you qualify for.

5. Can I use a home equity loan to make repairs or renovations before selling my home?

Yes, many homeowners use home equity loans to fund renovations or repairs that increase their home’s market value. Renovations such as kitchen upgrades, fresh paint, or curb appeal improvements can help your home sell faster and at a higher price.

6. What should I do if my home doesn’t sell quickly after taking out a home equity loan?

If your home isn’t selling as quickly as expected, you may consider options such as refinancing the loan, extending its terms, or renting out the property temporarily. You may also want to review your pricing strategy with your realtor to ensure your home is competitively priced for the market.

Table: Home Equity Loan Breakdown

| Item | Description |

|---|---|

| Home Value | Your home’s current market value |

| Loan Amount | Maximum amount you can borrow (typically up to 80% of home value) |

| Interest Rate | Fixed or variable, depending on the loan type |

| Loan Term | Typically 5 to 30 years |

| Closing Costs | Fees associated with the sale (typically 2-5% of the sale price) |

Conclusion

A home equity loan can be a valuable tool for homeowners in Pembroke Pines looking to sell their property, providing the funds needed for repairs, renovations, or other selling expenses. By leveraging the equity in your home, you can enhance its appeal and potentially increase the sale price, ultimately making the process smoother and more profitable.

However, it’s important to carefully consider the terms and risks associated with a home equity loan. Ensuring you fully understand how the loan impacts your sale proceeds, as well as the responsibilities tied to repayment, is crucial. At Property Solution Services LLC, we recommend consulting with both a financial advisor and a real estate expert to navigate this process effectively. With the right guidance, a home equity loan can be a smart strategy for achieving a successful home sale and meeting your financial goals.

Whether you’re preparing your home for sale or exploring financing options, Property Solution Services LLC is here to provide expert advice and support to help you make informed decisions. Reach out today to learn how we can assist you every step of the way.